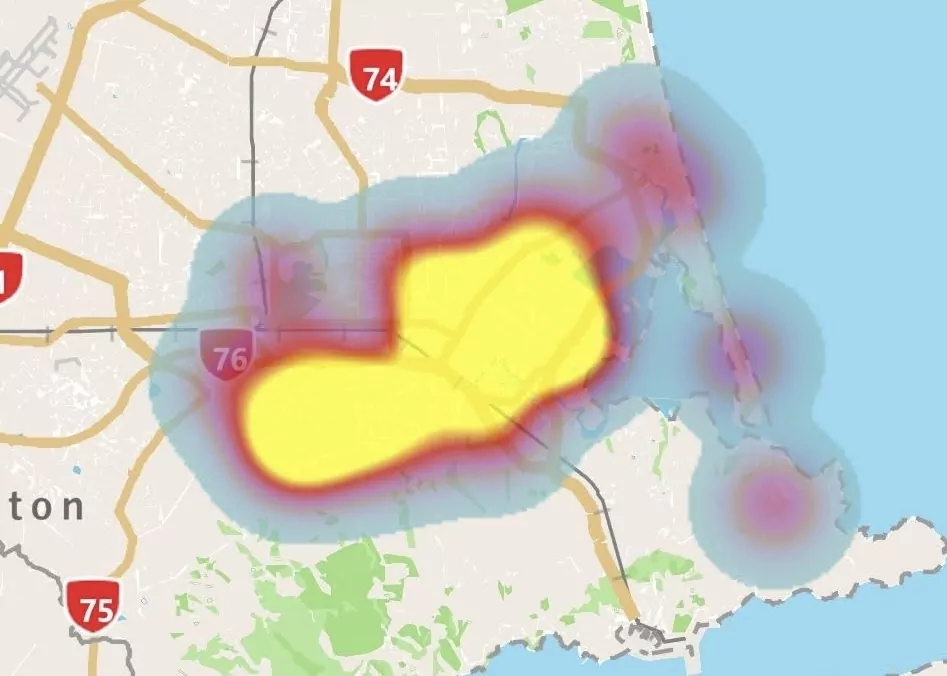

Escaped youth tracked by Eagle helicopter, found hiding in New Brighton

The young person who escaped from a youth justice facility in Rolleston has been located...

The Government today announced a new temporary payment to support New Zealanders who lose their jobs due to the global COVID-19 pandemic to adjust and find new employment or retrain.

If you lose your job (including self-employment) from 1 March 2020 to 30 October 2020 due to COVID-19, you may be eligible for the COVID-19 Income Relief Payment. It’s available from 8 June 2020.

You can get up to 12 weeks of payments, to help with living costs after a sudden job loss, and give you time to find other work.

You can apply online for the Income Relief Payment from 8 June 2020. If you need support before this date, we may be able to help you with a benefit or other payments in the meantime.

What you can get

The Income Relief Payment is paid for up to 12 weeks while you don’t have a job.

If you’re eligible for the payment, you can get:

$490 per week if you were previously working 30 hours or more a week

$250 per week if you were previously working 15 hours to 29 hours a week.

You don’t need to pay tax on this payment.

The Income Relief Payment will stop after you’ve had 12 weeks of payments, or if your situation changes and you no longer qualify.

Who can get it

You may be able to apply for the Income Relief Payment if you:

lost your last job or self-employment from 1 March 2020 to 30 October 2020 (inclusive) because of the impacts of COVID-19, and

normally worked 15 hours or more a week (for 12 weeks or more) before you lost your work because of COVID-19.

You must also be:

a New Zealand citizen or a resident who normally works and lives in New Zealand, and

18 years old or over, or a financially independent 16- or 17-year-old.

In a relationship

If you’re in a relationship with a partner, you can both get the Income Relief Payment if you both meet the criteria for who can get it.

You will not qualify for the Income Relief Payment if you have a partner earning $2,000 or more in wages or salary each week, before tax.

Already getting a benefit or a COVID-19 payment

If you (or your partner) are already getting a main benefit, you can choose to switch to the Income Relief Payment from 8 June, if you meet the criteria for who can get it.

You can’t get the Income Relief Payment and COVID-19 Wage Subsidy or Leave Support payments at the same time.

Studying

If you’re a student, you may be able to get the Income Relief Payment if you meet the criteria for who can get it.

You can receive the Income Relief Payment at the same time as receiving a Student Loan for living costs.

If you or your partner get Student Allowance, you may get the Income Relief Payment at the same time – but only at the part-time rate of $250 per week.

However, if you lost a full-time job (30 hours or more a week), you (and your partner) may choose to switch to the Income Relief Payment instead of your Student Allowance.

Self-employed

If you were self employed, you may be able to get the Income Relief Payment if:

your business is no longer viable, with no upcoming work or income, because of COVID-19, and

you meet the criteria for who can get it.

If your business is still viable you may be able to get support from Inland Revenue’s Small Business Cashflow Loan and the COVID-19 Wage Subsidy.

If you have received, or you’re waiting for approval for a loan from the Small Business Cashflow Loan, you are not eligible for the Income Relief Payment.

Who can’t get it

You will not qualify for the COVID-19 Income Relief Payment if you:

get a redundancy payment of $30,000 or more, before tax

get or used to get private income protection insurance payments for the job you lost

are getting earnings-related ACC payments

left your job for another reason – for example, you resigned, retired, wound up a viable business or were dismissed (eg. for misconduct)

still have a job.